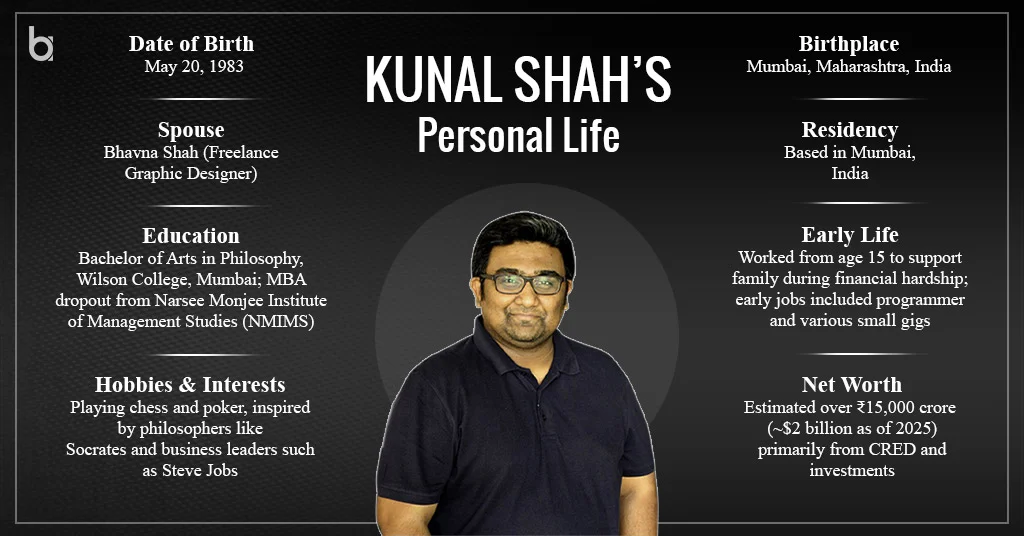

Explore Kunal Shah entrepreneurial journey with FreeCharge and CRED, diving into the debate over his businesses’ losses, profitability challenges, and long-term vision for India’s fintech landscape. Discover why his approach sparks inspiration.

Kunal Shah, the visionary behind FreeCharge and CRED, has become a polarizing figure in India’s startup ecosystem. Known for revolutionizing digital payments and building premium financial platforms, Shah’s ventures have sparked debates about business losses, profitability, and what it means to succeed as an entrepreneur. Despite his companies posting significant losses—₹5,215 crore for CRED alone over seven years—Shah’s influence and innovation continue to captivate investors and users alike. Let’s unpack his journey, the financial critiques, and why his long-term vision might outweigh short-term losses.

The Numbers Behind the Vision

To understand Shah’s journey, let’s look at the financials of his ventures:

| Venture | Year Founded | Peak Valuation | Revenue (Latest Known) | Losses (Latest Known) | Key Milestone |

|---|---|---|---|---|---|

| FreeCharge | 2010 | ₹2,800 Cr (2015) | ₹35 Cr (FY15) | ₹269 Cr (FY15) | Acquired by Snapdeal (2015) |

| CRED | 2018 | $6.4 Bn (2024) | ₹2,473 Cr (FY24) | ₹609 Cr (FY24) | 66% revenue growth (FY24) |

These figures highlight Shah’s pattern of bold investments in growth, often at the cost of short-term profitability. While FreeCharge’s valuation drop raised eyebrows, CRED’s

The Rise of FreeCharge: A Game-Changer in Digital Payments

In 2010, Kunal Shah co-founded FreeCharge, a platform that simplified mobile recharges and utility payments. By 2015, FreeCharge had generated ₹35 crore in revenue but incurred ₹269 crore in losses, largely due to aggressive cashback strategies to attract users. Despite these losses, the company’s innovative approach caught the eye of Snapdeal, which acquired it for ₹2,800 crore in 2015. However, just two years later, Axis Bank bought FreeCharge for ₹370 crore—a mere 14% of its peak valuation. Critics, like Deloitte Senior Consultant Adarsh Samalopanan, have pointed to this as evidence of overvaluation and unsustainable growth. Yet, supporters argue that FreeCharge laid the groundwork for India’s digital payment revolution, paving the way for platforms like UPI. Shah’s ability to exit at a high valuation showcased his knack for creating market-disrupting businesses.

CRED: Targeting India’s Affluent with a Premium Fintech Model

In 2018, Shah launched CRED, a fintech platform targeting India’s affluent credit card users. With a valuation of $6.4 billion in 2024, CRED rewards users for timely bill payments and offers premium services like personal loans, wealth management, and travel bookings. In FY24, CRED’s revenue surged 66% to ₹2,473 crore, while operating losses dropped 41% to ₹609 crore—a sign of progress toward profitability. Shah has emphasized that CRED’s focus on India’s top 30-40 million affluent consumers, who drive 70-80% of discretionary spending, is a deliberate strategy to build a high-quality user base. This niche approach prioritizes brand loyalty and engagement over immediate profits, a choice Shah defends as essential for long-term success.

The Profitability Debate: Vision vs Numbers

Critics like Samalopanan have questioned why Shah is celebrated despite 15 years of unprofitability across his ventures. A viral LinkedIn post highlighted CRED’s cumulative losses of ₹5,215 crore against ₹4,493 crore in revenue, sparking heated discussions. Some argue that Shah’s focus on growth over profit fuels unsustainable valuations, with FreeCharge’s eventual sale at a fraction of its peak value as a cautionary tale. Others, however, see Shah’s losses as strategic investments in market disruption. “He doesn’t just build companies—he changes markets,” one LinkedIn user commented, pointing to FreeCharge’s role in shaping digital payments and CRED’s transformation of credit card management into a premium experience.

Shah himself has responded to these critiques with nuance. In a rare comment, he acknowledged the validity of profitability concerns but emphasized the need for risk-taking in an evolving economy. “We should celebrate thousands of entrepreneurs who have created profitable companies without external capital,” he said, advocating for more job creators in a post-AI world. Shah’s focus on building distribution channels and user trust aligns with his belief that profitability will follow once the foundation is set.

Lessons for Entrepreneurs: Balancing Vision and Viability

His journey offers valuable lessons for aspiring entrepreneurs. First, targeting a niche audience can create a loyal user base, as seen with CRED’s affluent customers. Second, losses are sometimes a necessary trade-off for market disruption, but they must be paired with a clear path to profitability. Shah’s goal of reaching EBITDA breakeven by FY26 shows his commitment to balancing growth with financial discipline. Finally, his story underscores the importance of resilience—Shah’s early days selling henna cones to support his family highlight his grit, a trait that continues to define his ventures.

For startups seeking Google AdSense approval, Shah’s emphasis on quality and user engagement is a reminder to prioritize high-value content. Websites must offer original, informative articles and a seamless user experience to meet AdSense standards. Incorporating SEO best practices, like using relevant keywords (e.g., “Kunal Shah business strategy”) and building backlinks from reputable sites like Forbes India or Economic Times, can boost organic traffic and approval chances.

Why Shah’s Vision Resonates

His story isn’t just about numbers—it’s about redefining how businesses operate in India. FreeCharge democratized digital payments, while CRED is reshaping financial services for the elite. Despite the losses, Shah’s ability to secure investor confidence, with backing from Sequoia Capital and Tiger Global, reflects trust in his long-term vision. As India’s startup ecosystem matures, Shah’s journey challenges us to rethink success: Is it purely profit, or is it about creating lasting impact?

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making investment decisions. Consult a financial advisor for personalized guidance.

Read also – BMW Group India Breaks Sales Record with 10% Growth in First Half of 2025

1 thought on “Kunal Shah Business Journey: Decoding Losses, Profitability, and Vision”